Does Afterpay Affect Credit Score? Secret Insights for Accountable Borrowing

Does Afterpay Affect Credit Score? Secret Insights for Accountable Borrowing

Blog Article

Checking Out the Partnership Between Afterpay and Your Credit Rating

Amidst the convenience it supplies, concerns stick around concerning how making use of Afterpay may impact one's credit scores score. As people browse the realm of personal money, recognizing the elaborate relationship in between Afterpay use and credit history scores becomes paramount.

Afterpay: A Summary

Afterpay, a popular player in the buy-now-pay-later market, has rapidly gained appeal among customers looking for versatile settlement remedies. Established in Australia in 2014, Afterpay has increased globally, using its services to numerous clients in numerous nations, consisting of the USA, the United Kingdom, and Canada (does afterpay affect credit score). The system permits consumers to make purchases quickly and pay for them later on in 4 equal installments, without incurring interest costs if payments are made on time

One trick function that sets Afterpay apart is its smooth assimilation with online and in-store retailers, making it convenient for users to access the solution throughout a variety of purchasing experiences. In addition, Afterpay's simple application process and immediate authorization choices have added to its appeal amongst tech-savvy, budget-conscious consumers.

Comprehending Credit Score Rankings

As consumers involve with various monetary solutions like Afterpay, it comes to be necessary to understand the significance of credit rating scores in assessing people' creditworthiness and economic stability. A credit score rating is a mathematical representation of an individual's creditworthiness based upon their credit rating and existing monetary standing. Credit score scores are used by loan providers, landlords, and even employers to review a person's dependability in managing economic responsibilities.

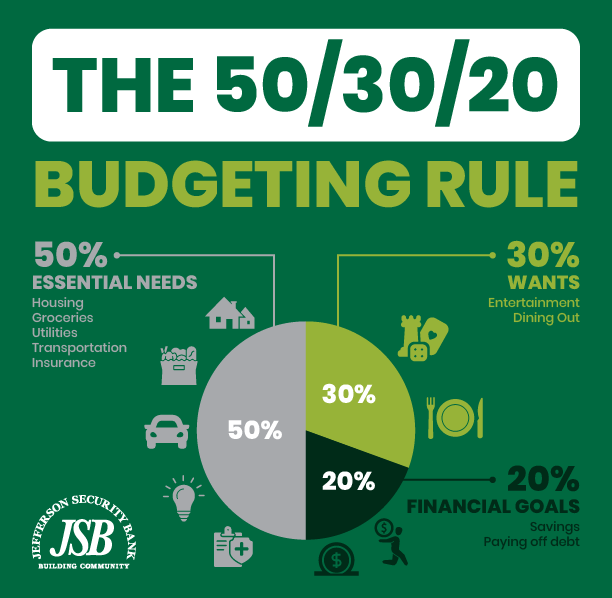

Credit history ratings normally vary from 300 to 850, with higher ratings indicating a reduced credit score danger. Aspects such as settlement background, credit rating utilization, size of credit rating, kinds of charge account, and brand-new credit report inquiries influence an individual's credit score. A good credit rating not only raises the likelihood of lending authorizations however also enables access to much better passion rates and terms.

Comprehending credit rating ratings equips people to make informed monetary decisions, build a positive credit rating, and boost their total economic health - does afterpay affect credit score. Frequently keeping an eye on one's credit rating report and taking steps to maintain a healthy and balanced credit report can have resilient advantages in managing funds properly

Aspects Influencing Credit Rating

Keeping credit scores card equilibriums reduced in relationship to the readily available credit report limitation shows responsible monetary actions. The length of credit score history is an additional aspect considered; a longer history generally shows even more experience handling credit rating. The mix of credit report types, such as credit scores cards, home mortgages, and installment fundings, can affect the score favorably if managed well.

Afterpay Use and Credit Scores Score

Taking into consideration the impact of numerous monetary choices on click over here now credit rating, the use of solutions like Afterpay can present unique factors to consider in examining a person's credit score. While Afterpay does not conduct credit report checks prior to authorizing users for their solution, late settlements or defaults can still have consequences on one's credit report. When individuals miss settlements on their Afterpay acquisitions, it can cause negative marks on their credit history file, potentially reducing their debt rating. Because Afterpay's time payment plan are not constantly reported to credit scores bureaus, responsible usage may not directly impact credit history favorably. Nevertheless, consistent missed out on repayments can reflect inadequately on a person's credit reliability. Furthermore, constant usage of Afterpay may click for source suggest economic instability or a failure to handle expenditures within one's ways, which can also be factored into credit scores analyses by lenders. For that reason, while Afterpay itself might not directly effect credit report ratings, how individuals handle their Afterpay accounts and linked repayments can affect their total credit rating.

Tips for Taking Care Of Afterpay Properly

To efficiently manage Afterpay and maintain financial stability, it is important to stick to a regimented repayment timetable and budgeting method. Establishing a budget plan that includes Afterpay purchases and making sure that the settlements fit within your total monetary plan is critical. It is very important to only use Afterpay for products you absolutely need or budgeted for, as opposed to as a method to spend too much. Checking your Afterpay transactions consistently can assist you remain on top of your repayments and stay clear of any kind of shocks. Additionally, maintaining track of your total amount superior Afterpay equilibriums and due days can avoid missed out on payments and late costs. Reaching out to Afterpay or developing a settlement plan can help you avoid harmful your debt rating if you find yourself battling to make settlements. By being aggressive and liable in managing your Afterpay usage, you can delight in the convenience it uses without compromising your financial health.

Verdict

In final thought, the relationship in between Afterpay and credit history ratings is complex. Taking care of Afterpay responsibly by staying clear of and making prompt repayments overspending can aid alleviate any adverse impacts on your credit scores ranking.

Aspects such as payment background, credit history utilization, size of credit rating history, kinds of credit report accounts, and new debt queries affect a person's credit report score.Thinking about the influence of different financial click to find out more decisions on credit scores, the application of services like Afterpay can provide one-of-a-kind considerations in examining an individual's credit score rating. When individuals miss out on settlements on their Afterpay purchases, it can lead to negative marks on their credit rating data, possibly decreasing their credit rating score. Considering that Afterpay's installment strategies are not always reported to credit history bureaus, accountable usage might not directly effect credit scores positively. While Afterpay itself might not directly influence credit rating scores, exactly how individuals manage their Afterpay accounts and connected settlements can affect their total credit scores rating.

Report this page